ny paid family leave tax opt out

NY Paid Family Leave. Opting OutWaivers Paid Family Leave is not optional for eligible.

If your employer participates in New York States Paid Family Leave program you need to know the following.

. EMPLOYEE OPT-OUT OF PAID FAMILY LEAVE BENEFITS. Seasonal may opt out of Paid Family Leave. When practical employees should provide 30 days advance notice of their intention to use Paid Family Leave.

If you need assistance contact the Paid Family Leave Helpline at 844-337-6303 wwwnygovPaidFamilyLeave. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Paid Family Leave Act rates are set by New.

You may request voluntary tax withholding. Beginning January 1 2018 employees may use paid family leave. Paid Family Leave is a mandatory benefit for employees who do not fall into an excluded class and work at a Covered Employer just like.

Enhanced Disability and Paid Family Leave Benefits. PFL-Waiver - Employee Paid Family Leave Opt-Out and Waiver of Benefits. If you have difficulty in obtaining the Paid Family Leave forms or need help in completing these forms please contact the PFL Helpline at 844-337-6303.

Can Employees Opt-Out Of NY Paid Family Leave. Your employer will not automatically withhold taxes from these benefits. The contribution remains at just over half of one.

Employers are to take deductions of 0511 of employees gross weekly wages up to the annualized New York State Average Weekly Wage NYSAWW. Employee Paid Family Leave Opt. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

Employers must offer employees who will not meet minimum eligibility criteria the choice to opt out by completing a Paid Family Leave waiver which is available at ny. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1.

Employees will see this deduction from their checks starting 112019. Each year the Department of Financial Services sets the employee contribution rate to match. To bond with the employees child during the first 12 months after the childs birth or after the.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Rate is based on an employees salary. Any benefits you receive under this program are taxable and included in your federal gross income.

Employer must keep a copy of the fully executed waiver on file for as long as the employee remains in employment with the covered employer. You will receive either Form 1099-G or Form 1099-MISC. NY Paid Family Leave.

Employee Paid Family Leave Opt-Out and Waiver of Benefits If an employee does not expect to work long enough to qualify for PFL a seasonal worker for example the. These rates and contributions are subject to change in future years. In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy so working families would not have to choose between caring for their loved ones and.

Taxation Guidance Is Finally Here for NY Paid Family Leave. Fully Funded by Employees. Employer must keep a copy of the fully executed waiver on file for as long as the employee remains in employment with the covered employer.

Opting-Out Of Coverage In most cases Paid Family Leave PFL is a mandatory benefit for employees who do not fall into an excluded class. Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay.

Any benefits you receive under this program are taxable and included in. Increased monetary pay out a shorter waiting period duration to. Yes NY PFL benefits are considered taxable non-wage income subject.

An employer may choose to provide enhanced benefits such as. Use of NY Family Leave. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

Ny Paid Family Leave Opting Out Shelterpoint

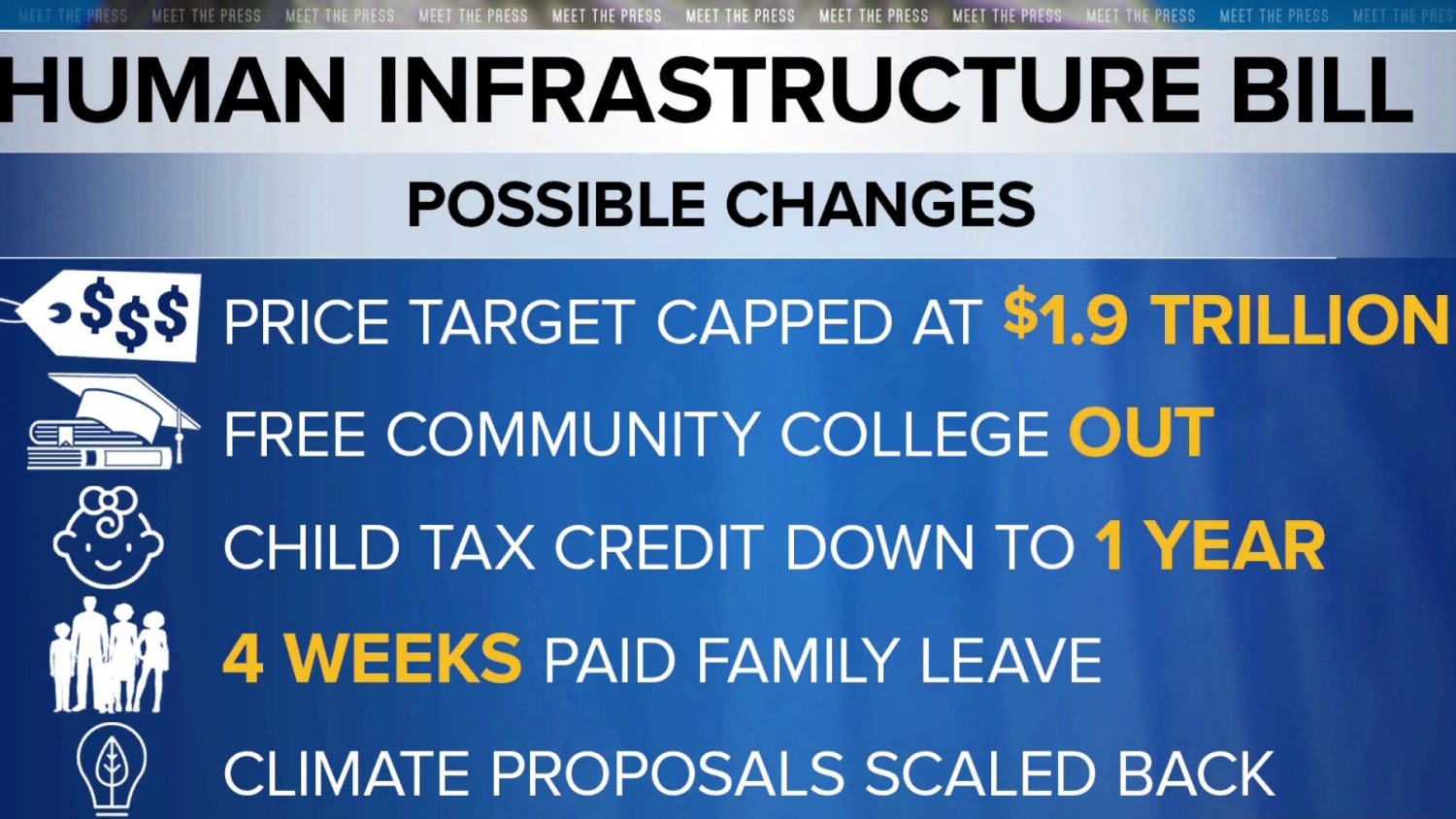

Biden S Child Tax Credit Community College And Paid Family Leave Plans May Be Cut

Ny Paid Family Leave Opting Out Shelterpoint

Cost And Deductions Paid Family Leave

Ny Paid Family Leave Opting Out Shelterpoint

Update New York State S Paid Family Leave Program

District Of Columbia Paid Family And Medical Leave Dc Pfml The Hartford

New York Paid Family Leave Resource Guide

New York State Paid Family Leave Cornell University Division Of Human Resources

Get Ready For New York Paid Family Leave In 2021 Sequoia

![]()

Pfl Waiver Form Paid Family Leave

Cost And Deductions Paid Family Leave

New York State Paid Family Leave Takes Effect January 1 2018 Are You Ready Perlman And Perlman